Business spending shouldn’t be a guessing game. With Fluz, you get clarity, control, and confidence all without changing the way you work.

When it comes to paying vendors, managing recurring bills, or tracking spend across teams, most businesses face the same issue: complexity. Juggling multiple logins, remembering due dates across platforms, and pulling reports from different systems turns a routine task into a time-consuming process. It’s easy for payments to fall through the cracks, and even harder to get a clear view of where the money is going.

Fluz cuts through the clutter by making business payments flexible, transparent, and secure from day one.

Here’s how.

Pay your way—with no strings attached

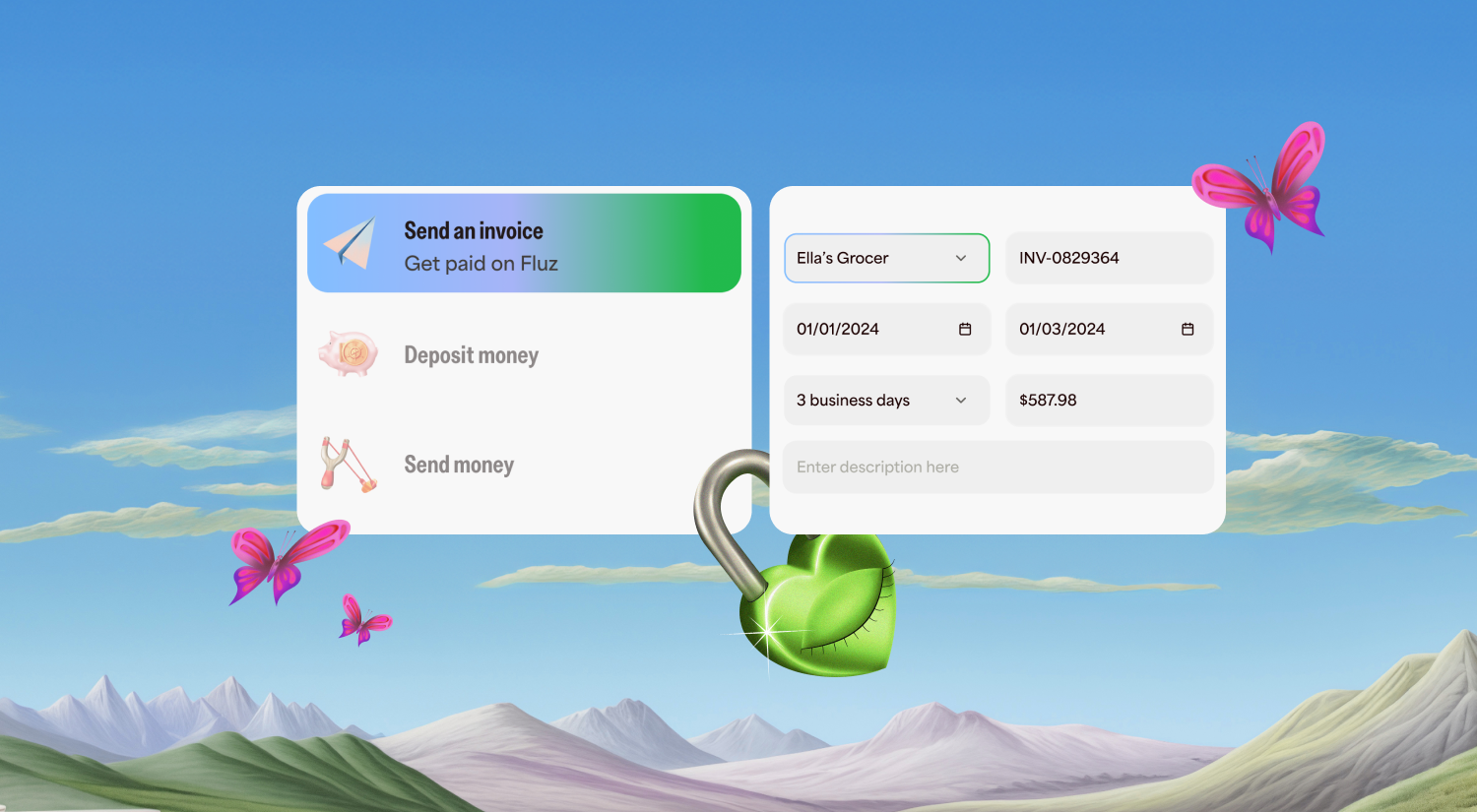

However your business handles payments, Fluz fits right in. Forget platforms that require you to switch banks or preload balances. That takes time and can quickly add up on the to-do list. Instead, Fluz lets you pay your business bills on your terms. Choose to draw from your Fluz balance or link any bank account.

- Pay recurring bills or one-time charges

- Use your Fluz balance or any linked bank account

- Add your own billers or pay through our existing network

No locked-in funding rules. No platform gymnastics. Just seamless, flexible business payments.

Get insights that go deeper than your dashboard

Most expense platforms only show you the “what” like a list of charges or a monthly total. Fluz goes further by revealing the why, the where, and what’s next. Want to know why marketing spend jumped last week? Filter transactions by category, account type, or even vendor to see the full picture. Need to track monthly software subscriptions? Sort by recurring charges and monitor tools like Zoom, Slack, or Notion. Preparing for a quarterly report? Export filtered data to CSV by spend category or team and share it directly with finance. With Fluz, you don’t just get records—you get answers.

- Advanced filters let you drill down by vendor, team, or spend category

- CSV exports make audits and reporting fast and painless

- API access allows you to sync transactions to your existing systems

It’s more than tracking. Fluz offers total visibility, on your terms.

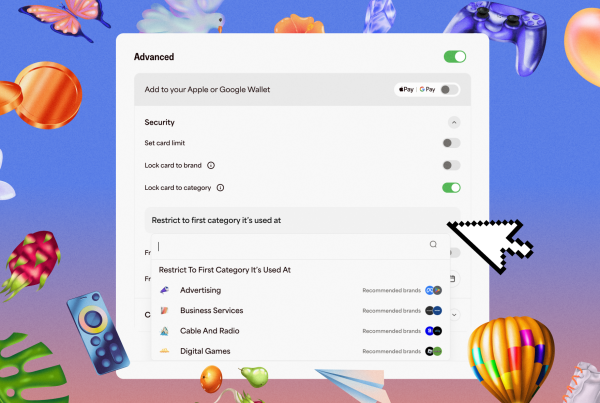

Built-in security, no compromises

When every payment is digital, security isn’t optional—it’s essential. Fluz is built to protect your cash and your team from the start. Each transaction is powered by a virtual card with bank-level security. Using a fingerprint, Face ID, or passcode adds another layer of protection, ensuring that only authorized users can send or approve payments.

- Single-use virtual cards for every transaction

- Face ID required for added verification

- Bank-grade security, no trade-offs

Spend with confidence. Fluz takes care of the rest.

No credit checks. No sign-up fees. No surprises.

With Fluz, there are no hidden fees.* You don’t have to fund a Fluz account in advance, and we’ll never make you jump through hoops just to access your own money.

- No credit checks

- No sign-up or platform fees

- No forced account switches

Your business, your bank, your way. Fluz just makes it easier.

*Members can use Fluz app in conjunction with the bank accounts, debit or credit cards they already have. Members do not need to commit to annual or monthly membership fees.

There are no fees for virtual card and gift card transactions funded by a US bank account made in the US. There are fees for funding your digital wallet balance via Debit or Credit card. There are international currency conversion fees charged by Visa for international transactions on the virtual card.

Ready to simplify your business payments?

Payments shouldn’t slow you down. Fluz helps your business move faster—with less friction and more control.

Whether you’re scaling a startup, managing multiple teams, or simply tired of expense platforms that overcomplicate the basics, Fluz gives you a smarter way to manage every dollar in motion.