Get the payment experience you imagine.

Flexible solutions to add money movement at scale to your platform, program, or workflow.

Flexible solutions to add money movement at scale to your platform, program, or workflow.

Fluz has processed $5 billion across cards, wallets, pay-ins, payouts, and bill payments.

Use these solutions together or on their own to move money through your platform, program or workflow.

Bring money into your platform through configurable funding flows.

Key benefits

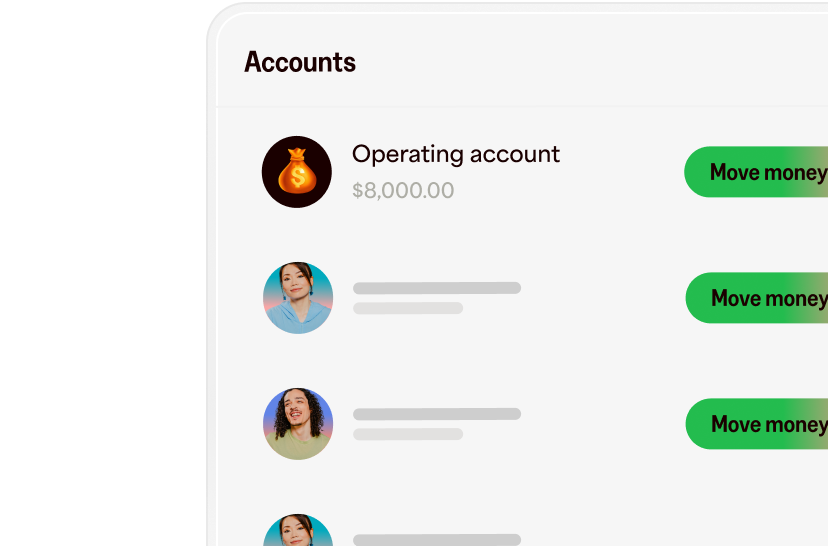

Create dedicated wallets to govern how funds are held and used.

Key benefits

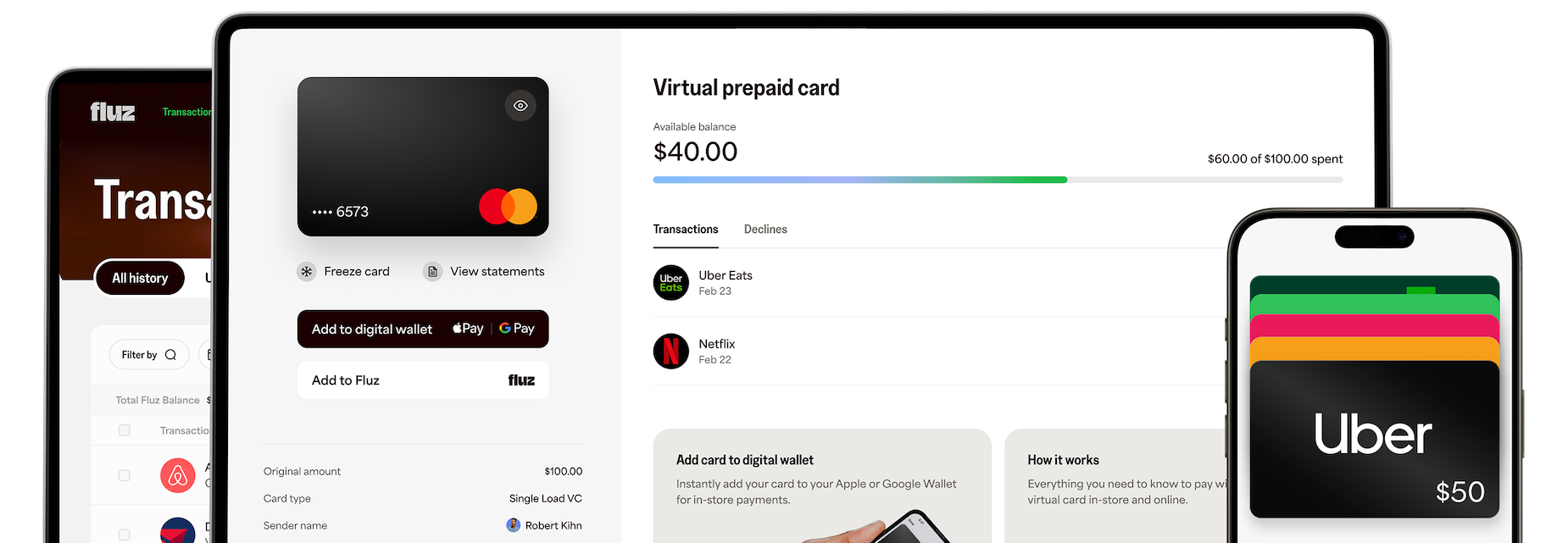

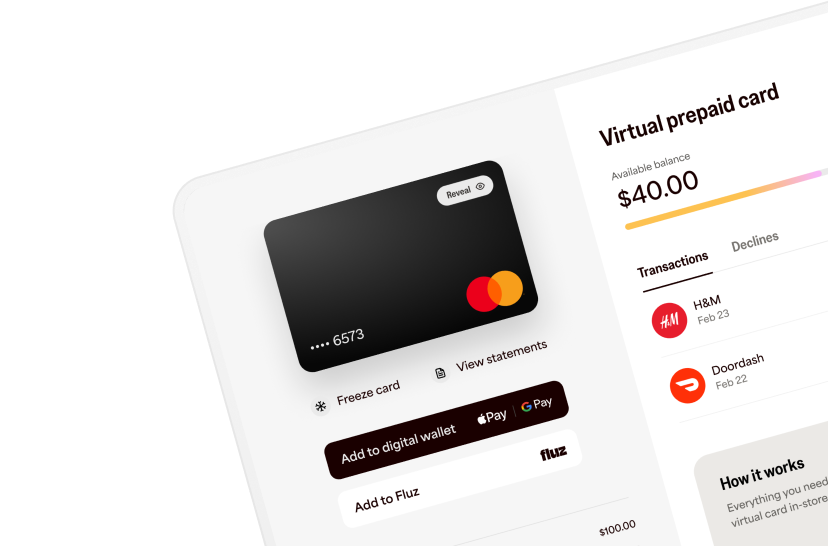

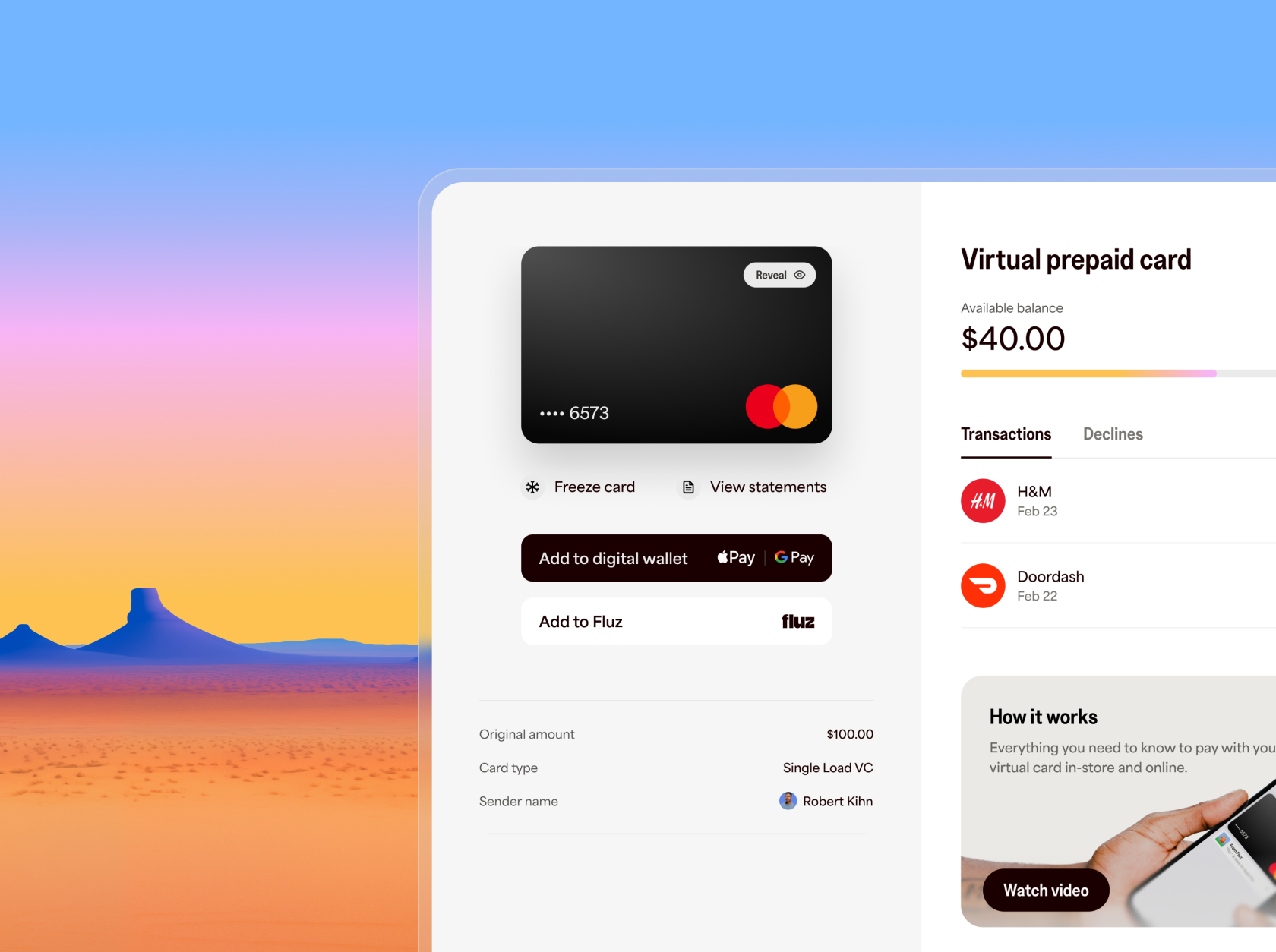

Enable controlled spending through branded virtual cards embedded in your platform.

Key benefits

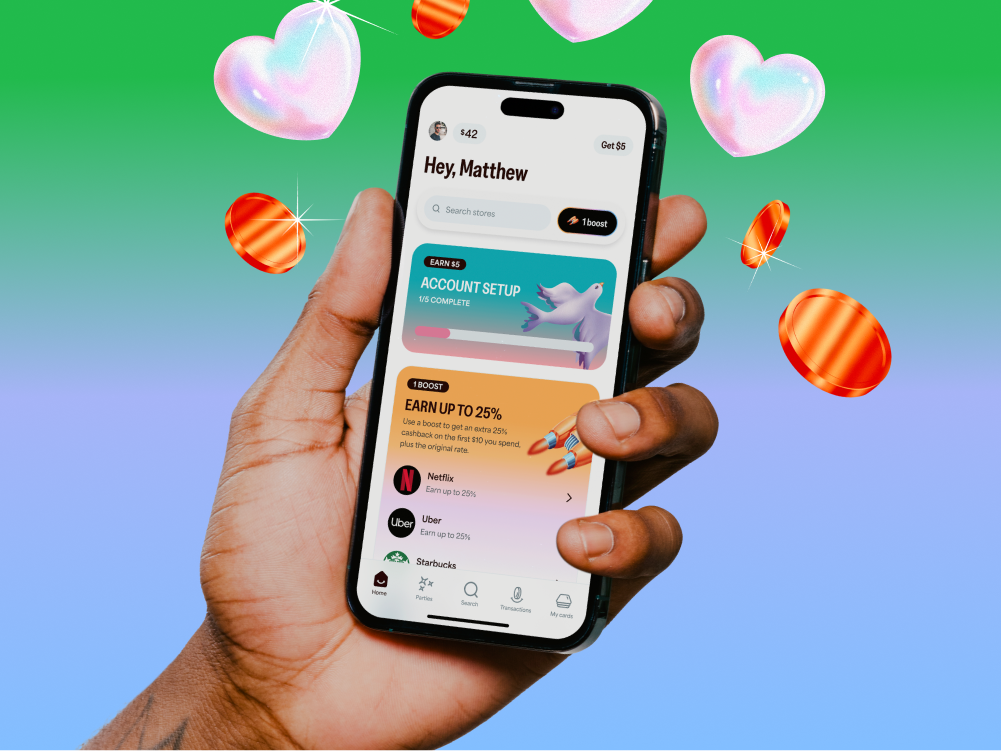

Distribute incentives and rewards through flexible digital payout options.

Key benefits

Deliver fast, secure payouts across preferred payment methods from one platform.

Key benefits

Share your vision. We’ll guide you from setup to launch.

Real-world examples showing how teams design, launch, and scale modern payment experiences using our platform.

Proven payment rails, compliance, and operations that are built and battle-tested. Tailored to your use case, branded for your customers, deployed at scale.

Proven payment rails for rewards, payouts, and spend. Configured and deployed in weeks, not quarters.

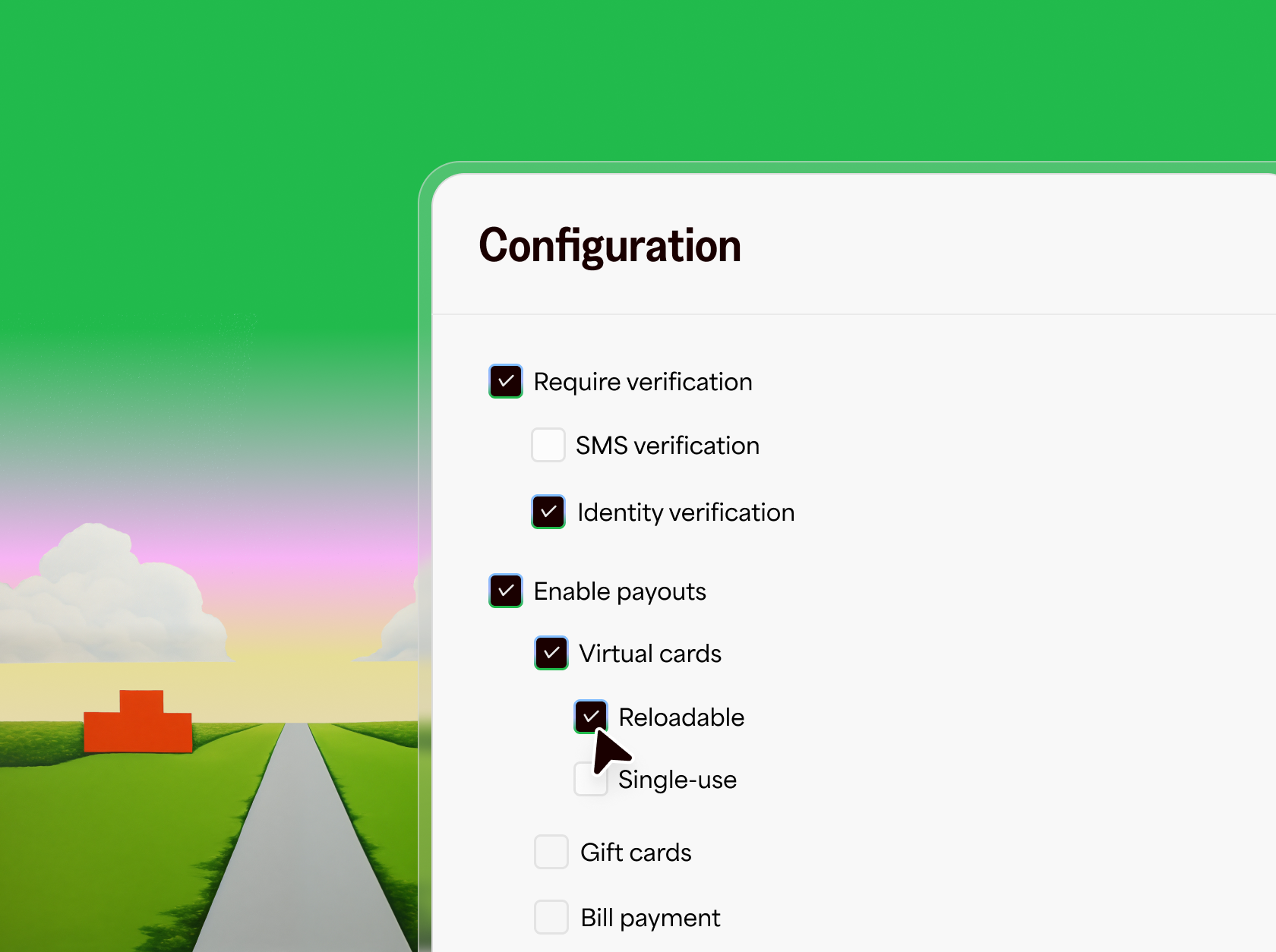

Define how money moves through your platform. Routing, compliance, KYC, and settlement run automatically behind the scenes.

Instant delivery, flexible redemption, and mobile-ready cards, fully integrated into one seamless payout experience.

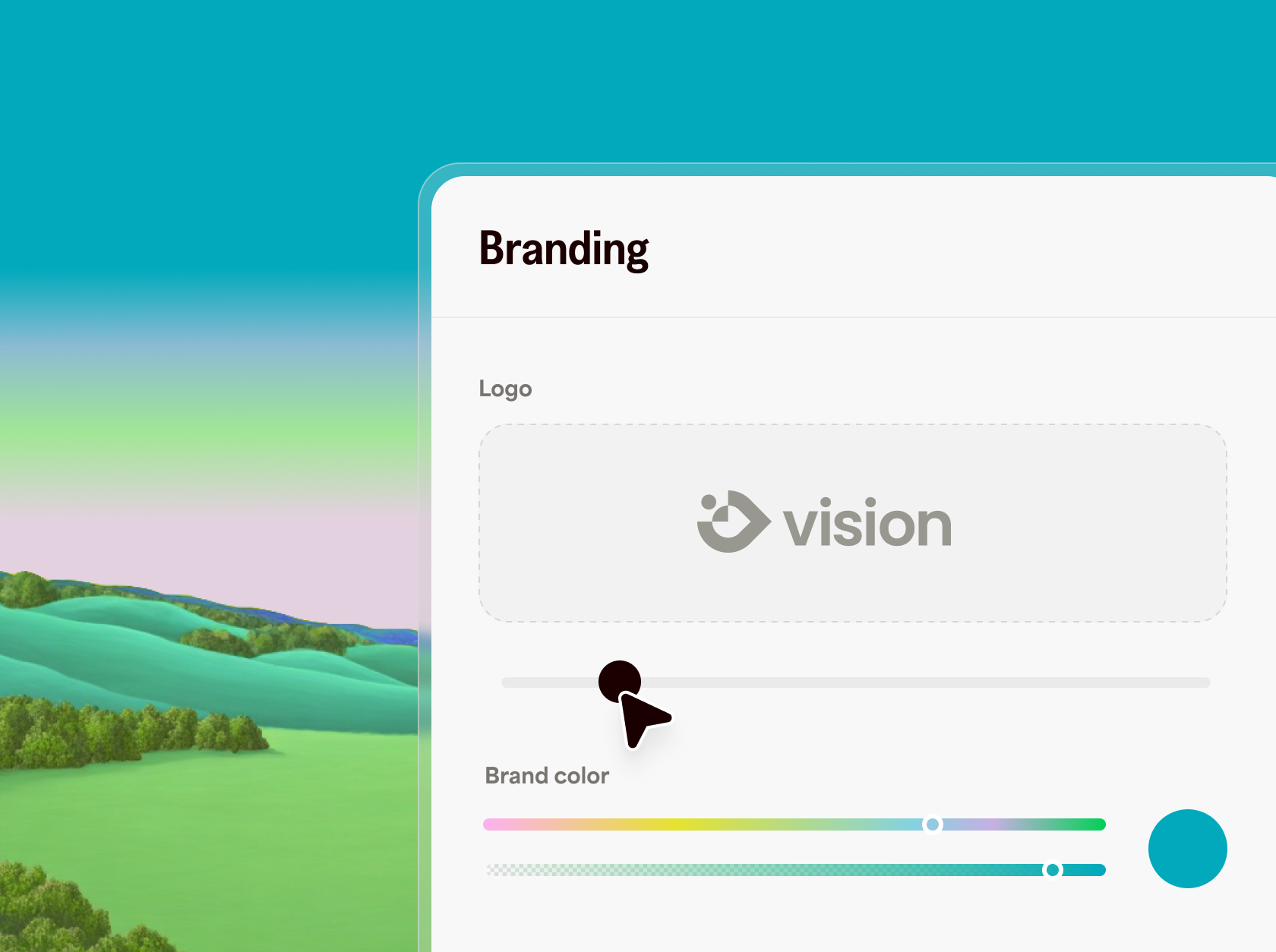

Your logo, colors, and messaging across the entire experience. Recipients experience your brand, not a payment provider.

Fluz provides multiple paths to speed up launch, reducing integration effort and friction across teams and systems.

Use our platform, widgets and plug-and-play snippets to deliver rich payments experiences without building infrastructure.

Drop-in adapters that extend your existing integrations, letting you add Fluz capabilities without rebuilding your stack.

Connect your existing merchant account once to support multiple gateways, with Level 2/3 data, network tokens, and built-in risk controls.

OAuth-secured KYB/KYC forms with API validation. Automated compliance—no PDFs, no manual transcription, no delays.

Full documentation with prebuilt, use-case-specific recipes to streamline implementation.

Go to market faster with hands-on support from initial design through production, launch, and scale, with a team that stays with you.

Most platforms deliver money as a one-off event—then push users into a generic third-party portal. Fluz delivers a connected financial experience recipients can return to, manage, and trust.

Instead of a disposable card or forgotten link, Fluz gives recipients access to a persistent account experience—available across web, mobile, and embedded surfaces.

Recipients aren’t sent to a generic portal they won’t recognize. They’re brought into a branded, searchable platform they can return to—reducing confusion and creating an experience people remember and trust.

No passwords to forget. Accounts are securely linked to a phone number, making access instant and familiar.

Security, compliance, and reliability move together. Fluz applies bank-grade controls, continuous monitoring, and regulated partnerships to protect data and funds while supporting flexible, real-world payment flows.

Fluz maintains SOC 2 Type II controls to ensure secure handling of data across systems, processes, and integrations.

Card data is handled in accordance with PCI DSS requirements, reducing your compliance surface while maintaining flexibility.

Infrastructure and controls are built to meet the expectations of regulated financial institutions and enterprise partners.

Spend account funds are held by FDIC-insured banking partners, with deposit insurance coverage up to $10,000,000.

Transactions are monitored continuously with configurable limits, rules, and risk checks across funding and payouts.

US-headquartered, with infrastructure and controls designed to meet the demands of regulated financial environments.

— Telesign, 2024 Trust Index Report

Design, launch, and scale payment experiences your users will love.